Describe the Four-step Process of Figuring Out Your Monthly Budget

Feed a system crap data and its going. The size of the National Government deficit.

The Three Part Writing Process Business Communication Skills For Managers

2y 4 2y 16.

. Monitor Your Budget. Checking accuracy of actual income and expenditure reported. Starting from the initial planning stage the company goes through a series of stages to finally implement the budget.

Add up the total monthly income you and your partner earn. Whether you use a pen and paper or financial software the basic process to set up your budget is always the same. Wastage in the national health budget.

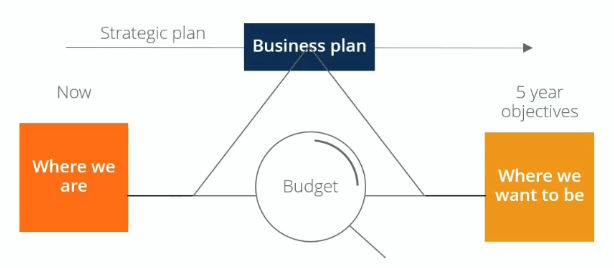

This is the objective of preparing the macro-economic framework. Common processes include communication within executive management establishing objectives and targets developing a detailed budget compilation and revision of budget model budget committee review and approval. Developing an objective understanding of money as a tool can help you use it to your advantage by minimizing waste and maximizing.

When creating a personal budget it is best to start by making a list of necessities that you have to pay each month. Look at your pay stubs to figure out the income for the month. Heres how it works.

4 Step Budgeting Process. Mortgage or rent utilities gas electric watersewer public transportation medical expenses and groceries. Highlighting any variations to the budget owner.

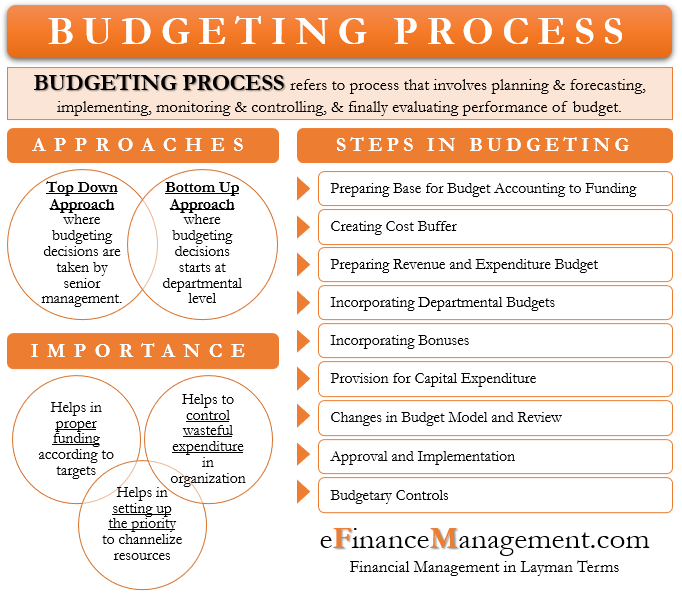

Budgeting process involves planning and forecasting implementing monitoring and controlling and evaluating the performance of the budget. Next list all your monthly expenses. How to create a budget.

Under-spending in the Sunrise State Department of Health. Divide 4 from both sides. Now that y is 4 substitute it into the first equation to get x.

If you earn 2400 before tax biweekly multiply that number by 26 then divide by 12 to determine your monthly income. Next list all your monthly credit card debt. Financial constraints are built into the process from the very start.

Within the company each department typically also has a budget. Your project is likely not the first to try and accomplish a specific objective or goal. Then subtract your total expenses from your total income to determine your net monthly cash flow.

First list all your monthly income. First list all your monthly income. Determine average monthly costs for each expense.

Budget planning requires the delicate balance of meeting financial goals while ensuring patients receive high. Four Steps to Budgeting. To do this weve outlined seven essential steps toward creating and managing your project budget.

Specific projects also have their own budgets and often different phases of budget to manage. First list all your monthly income. Looking back at similar projects and their budgets is a great way to get a headstart on building your budget.

In many cases the budget is split into two or more purpose-specific budgets like a marketing budget and a budget for entertaining clients. The budgetary control process ensures funds are being utilised in. Finally make adjustments as needed.

Next list all your monthly expenses. X y 4. Choose the correct answer below.

Add like terms. Calculate your net income. Without it even the most sophisticated sales forecasting process will struggle to give you any insight.

First list all your monthly income. How much money is allocated to primary health care within the. Create a List of Expenses.

Label fixed and variable expenses. Then subtract your total credit card debt from your total income to determine the amount of interest being paid each month. Describe the four-step process of figuring out your monthly budget.

The total amount being allocated to Sunrise State. 4y 8 16. That way you wont be discouraged if you bust your budget in the first month.

2x 2y 16. Breaking the budgeting process down into manageable steps can help you to understand it and can increase the chances that you will stick with it and gain control of your personal finances. Figure Out Your Goals.

Comparing actuals with budgets. X 4 4. Use the system thats best for you whether on paper or using budgeting software.

Ad Learn How To Make A Budget In Just 10 Minutes Find An Extra 400 In Your First Month. Formulating expenditure policies. It also provides guidance on how to best use human and material resources.

Subtract 8 from both sides. First list all your monthly income. Learn How To Budget Save Money In Just 10 Minutes With Ramsey.

Your income expenses and spending habits will change over time so its important to monitor your budget. Accordingly the budget formulation process has four major dimensions1 Setting up the fiscal targets and the level of expenditures compatible with these targets. Think of the idiom garbage-in garbage-out.

Taking the necessary action based on the monitoring results to ensure the budget remains within control. Finally make adjustments as needed. Next list all your monthly expenses.

Which stage of the Polarus budget process would you monitor if you were concerned about. Then subtract your total expenses from your total income to determine your net monthly cash flow. A unit budget is a plan that outlines a particular units goals and objectives as well as planned expenses and revenues in relation to the organization.

List your sources of income for the month. Every company has an operating budget. The next step in the sales forecasting process is to make sure the data youre about to use to conduct your forecast is as clean and accurate as possible.

Finally make adjustments as needed. 2y 8 2y 16.

Budgeting Overview And Steps In The Budgeting Process

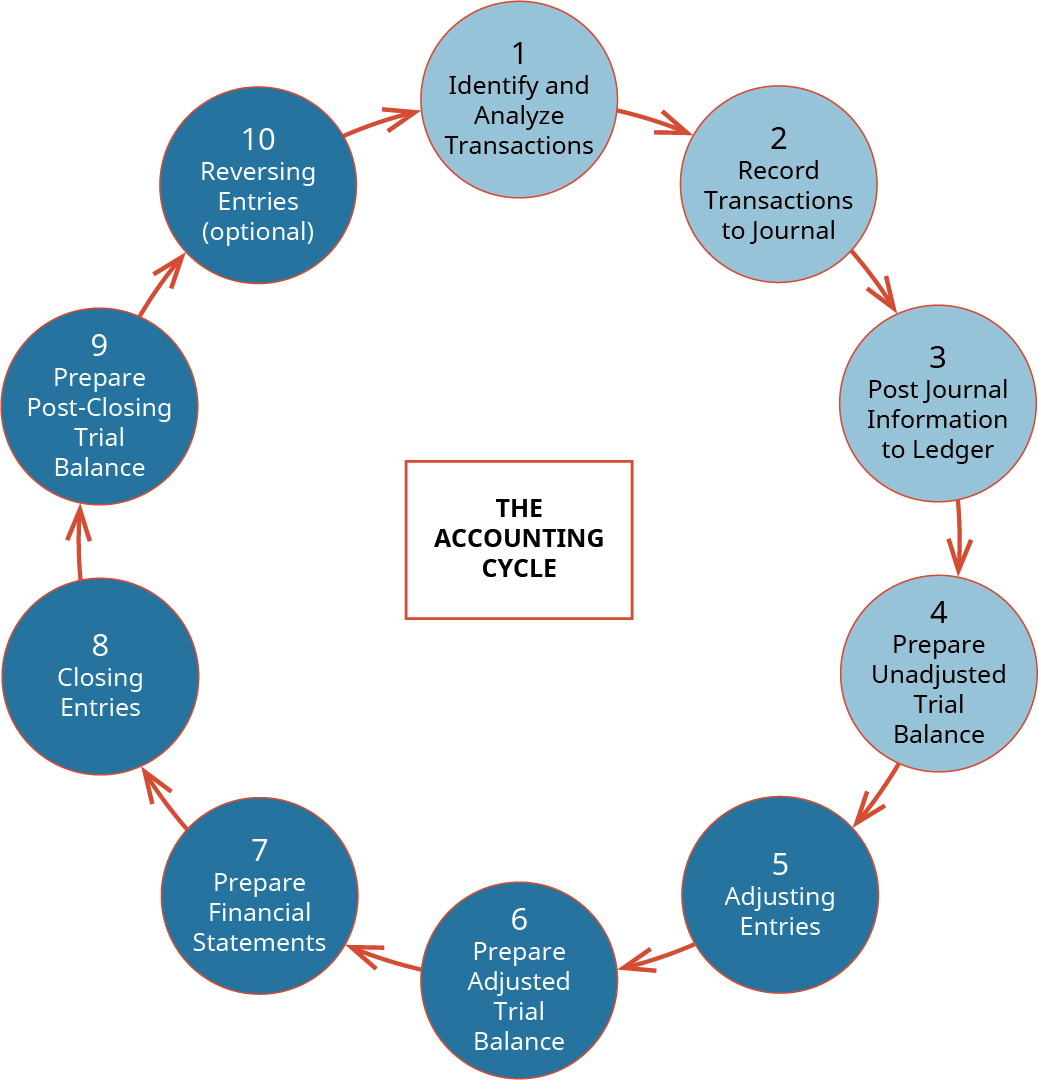

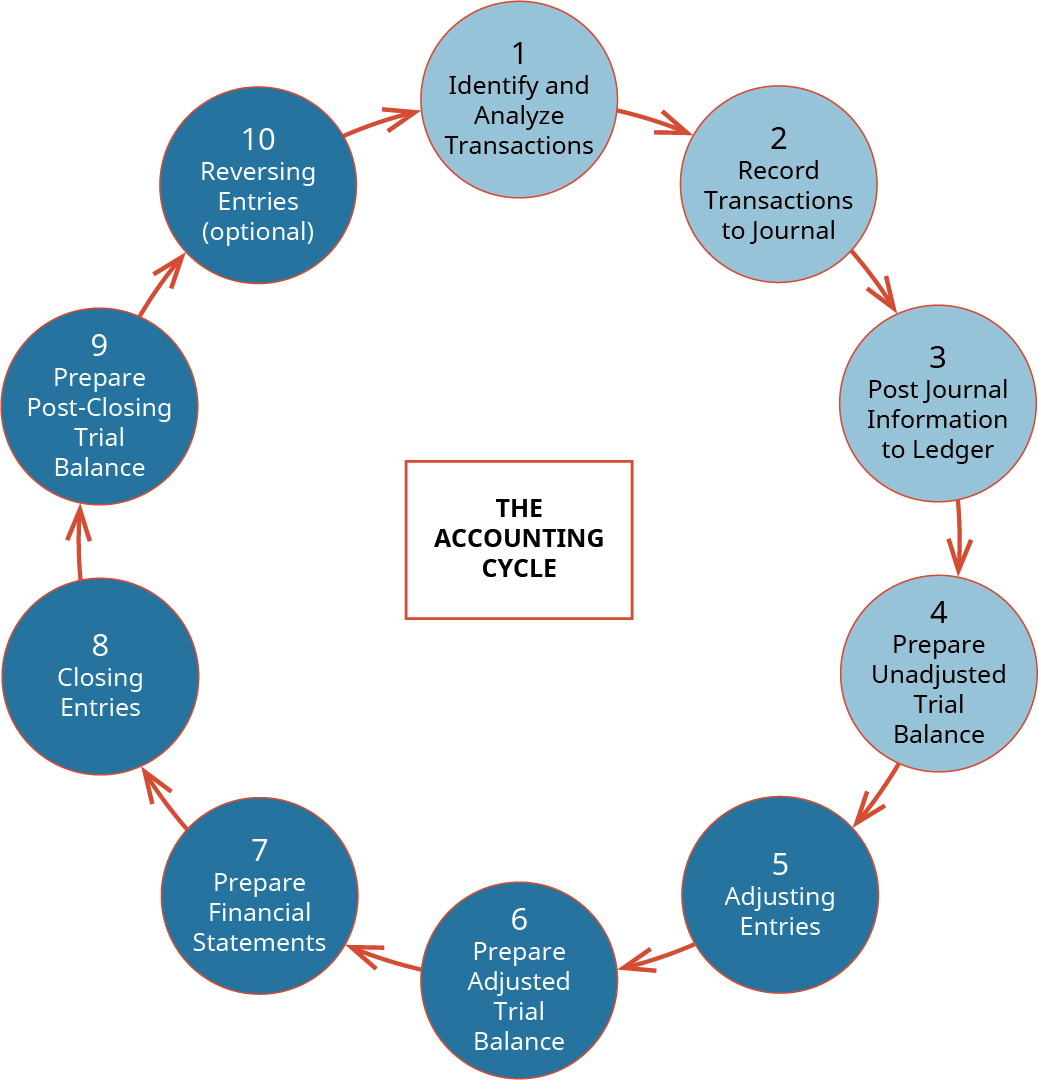

Define And Describe The Initial Steps In The Accounting Cycle Principles Of Accounting Volume 1 Financial Accounting

Budgeting Process Meaning Approaches Steps Importance

The Accounting Cycle And Closing Process Principlesofaccounting Com

0 Response to "Describe the Four-step Process of Figuring Out Your Monthly Budget"

Post a Comment